On 18 December 2024 and 5 March 2025, West Dunbartonshire Council will meet to agree its budget. In this consultation we are asking residents, businesses, and community partners for their views on the services that are most important to them, which will inform budget proposals for 2025/26.

We know that households across West Dunbartonshire are facing huge financial challenges. Rising prices make this a cost-of-living emergency. West Dunbartonshire Council is also facing its most difficult budget pressures for many years.

All local authorities are having to deal with large increases in inflation that are driving up costs and prices for energy, fuel, and materials. The budget gap for 2025/26 currently stands at £10 million, rising to £41 million by 2028/29. This position may change after we have worked through the implications of the local government’s final budget settlement expected in December.

We manage the Council’s finances responsibly and plan ahead carefully to meet current and future financial challenges. Our financial outlook has been exacerbated for a variety of reasons but primarily:

- The Scottish Government not fully funding the 2022/23 & 2023/24 pay awards

- Increases in bank interest rates and general inflationary pressures which are not reflected in levels of Scottish Government funding

- The Scottish Government providing real terms funding cuts which leaves the Council having to absorb the impact of spiralling inflation on-going increases in utility costs and the impact of increases in bank interest rates

We have been listening to you about the big issues that matter most to you and your communities in our recent Citizens Panel. We have been guided by what you have told us about your experiences living in West Dunbartonshire.

We now want to hear your views on your priorities across several key areas. Together, all this feedback will help inform our decisions during the budget process.

The budget setting helps balance the main council budget; however this does not include the annual rent setting consultation and a separate consultation with all tenants will be carried out later in the year.

About the Council

Our vision is to lead positive change – delivering services which build on the strengths and resilience of our neighbourhoods and supporting all residents to fulfil their individual potential and that of their communities. We are focused on tackling inequality and disadvantage, working with our partners locally and nationally, investing in people, using our resources wisely, speaking up for West Dunbartonshire, and being inclusive and open. These are laid out in our Strategic Plan 2022-27.

2024/25 Investments and budget savings

West Dunbartonshire Council is on the frontline of supporting the most vulnerable people in our communities. We are committed to helping them and their families, for 2024/25 we have made a number of commitments to support families with the cost-of-living crisis, support our communities and improve health and wellbeing. View the full report of our investments and savings.

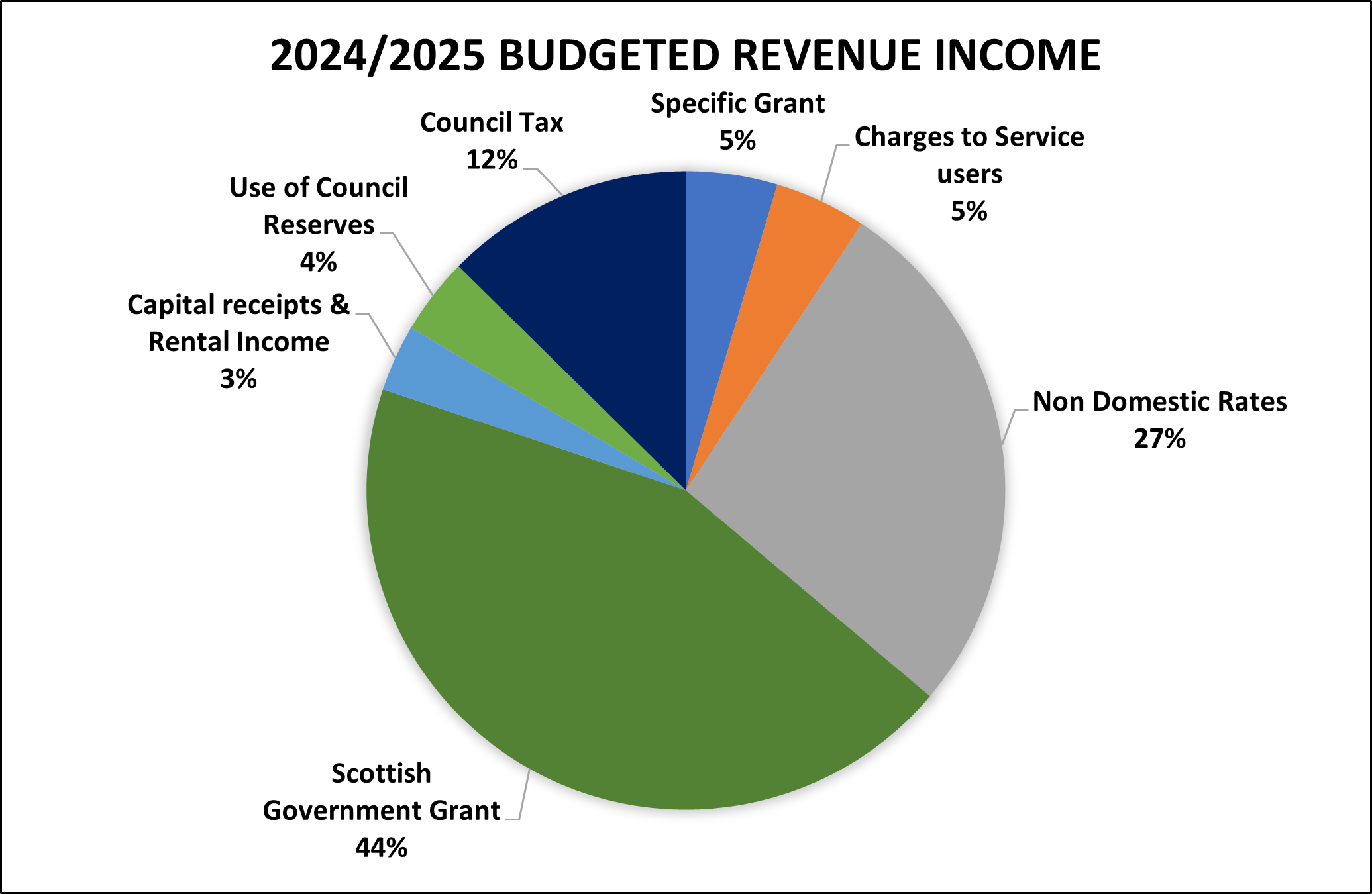

Where our money comes from

In 2024/25, 12% of the Council’s funding for services will come directly from council tax, with the rest coming from charging for services, government grants, non-domestic rates, and use of limited Council reserves.

Most of the funding can only be used for the purpose it has been given and cannot be allocated to day-to-day Council spending.

Revenue Budget: this is income that pays for the day-to-day delivery of Council services. It is predominantly made up of Scottish Government grants, Council Tax, Non-Domestic rates and charges for services; this budget is the main focus of the budget conversations for 2025/26.

Capital Budget: Capital projects are funded from a variety of sources including directly from the Scottish and UK Government (for example Levelling Up Funding) of which some is ring-fenced for specific projects. There are also some externally sourced grants or income from capital receipts. The remainder needs to be met through borrowing.

Examples of current capital projects are the regeneration of town centres including Glencairn House. This is a historic building which will be refurbished and put into use again. This is funded from Levelling up Funding which is ring-fenced for the specific purposes it was awarded. The Vale of Leven Cemetery will be extended and there is funding to improve streets and cycle lanes as well as investment in roads and flooding works.

Ring-fenced funding: this is money that comes various sources (mainly Scottish Government grants) that must be used on specific things such as healthcare and teaching. The Housing Revenue Account (HRA) is also ring-fenced, this is money that comes from household rents and can only be spent in housing areas.

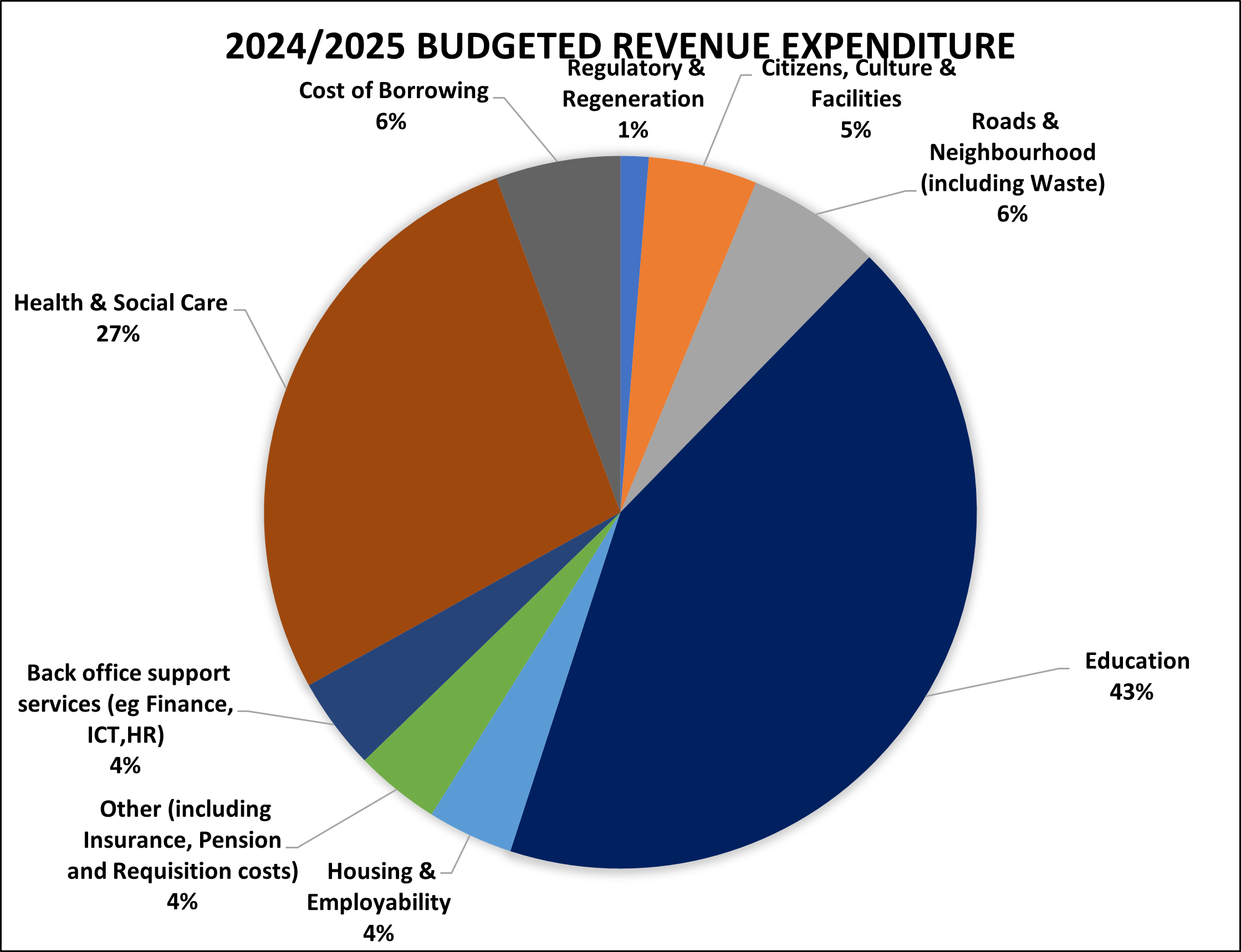

What we spend on council services

In 2024/25, the Council will spend just over £306 million on services. This is our total gross expenditure budget. In addition, we will also spend approximately £77m on capital projects; our capital programme includes investing in the regeneration of our town centres and infrastructure, new school buildings, new energy-efficient social housing, and other service needs reflecting the Council’s priorities.

Income from Council Tax

In 2024/25, we agreed to the Scottish Government’s Council Tax freeze and accepted £2.219m from the Scottish Government. This figure does not fully fund a Council Tax freeze.

The freeze means that the Band D Council Tax Rate will remain at £1,398.98.

The table below provides an example of how much additional income would be generated if a Council Tax increase is agreed in 2025/26.

Additional Income

|

2024/25 (based on Council Tax Band D) |

2025/26 |

|||

| Increase in council tax | 2024/25 Annual charge |

Additional cost per household per week | Additional cost per household per year | Total income generation for the Council (all council tax bands) |

|---|---|---|---|---|

|

1% |

£1,412.97 |

£0.27 |

£13.99 |

£405,000 |

|

3% |

£1,440.95 |

£0.81 |

£41.97 |

£1,215,000 |

|

5% |

£1,468.93 |

£1.35 |

£69.95 |

£2,025,000 |

|

7% |

£1,496.91 |

£1.88 |

£97.93 |

£2,835,000 |

|

10% |

£1,538.88 |

£2.69 |

£139.90 |

£4,050,000 |

Feedback

Please provide feedback via this survey: https://arcg.is/LqSuP